- RESOURCES -

What Are the Benefits of Long-Term Investing? | Read More | Wealthify.com

Discover the benefits of long-term investing and unlock the full growth potential of your savings. Read on to learn why long-term investing is essential.......

www.wealthify.com

6 Reasons to Buy-and-Hold Stocks for Long-Term Investing | U.S. Bank

Rather than trying to time the market, consider holding your investments longer with a buy-and-hold, passive investing strategy.......

www.usbank.com

7 Top Reasons To Save Your Money | Bankrate

Saving money can help you reach your goals, cover future expenses and minimize stress. Here are six ways saving money can benefit you significantly.......

www.bankrate.com

Chapter 3: Save and Invest - Building Wealth Online - Dallas Fed

......

www.dallasfed.org

Benefits of long-term investing: check out more details | Personal Finance - Business Standard

Long-Term Investing: Prior to making any investment decisions, research and analyse a product......

www.business-standard.com

Saving Vs. Investing: Key Differences And When To Choose | Bankrate

While saving and investing money go hand in hand, you may be surprised by which has more impact on wealth. Learn from Bankrate when to save and when to invest.......

www.bankrate.com

Saving vs. investing: How to choose the right strategy to hit your money goals | Fortune Recommends

While it’s become easier to invest with less money, saving is sometimes the better choice.......

fortune.com

Saving Money vs. Building Wealth: Key Differences

Understand the key differences between saving money and building wealth. Learn strategies to grow your savings and invest wisely to achieve long-term financial success.......

www.credit.org

6 steps to investing wisely | The Department of Financial Protection and Innovation

Long-term investing is one of the best ways to build wealth. To achieve goals such as saving enough for retirement, you must invest wisely.......

dfpi.ca.gov

Principles of Long Term Investment Success | TIAA

Investing principles are essential to long term success. Financial plans that protect your money while meeting your financial goals will make investing easy.......

www.tiaa.org

The Benefits of Long-Term Investing: Weathering Volatility and Achieving Financial Goals

......

www.raymondjames.com

Building Wealth: Strategies to Turn Your Income into Lasting Wealth

Building wealth involves more than just earning a high income; it requires a deliberate and disciplined approach to managing your finances.......

sagemintwealth.com

.jpg)

Need to Save Money? Read 10 Reasons to Save Money | HyperJar

Do you need motivation to save money? Read 10 reasons to save money and become independently financially literate with HyperJar. Click here for more.......

hyperjar.com

:max_bytes(150000):strip_icc()/article_12_image-5bfc2ff646e0fb0083c1475a.jpg)

Saving vs. Investing: Understanding the Key Differences

The terms saving and investing are sometimes used interchangeably, but they are very different and extremely important to understand.......

www.investopedia.com

Saving vs. Investing: 2 Ways to Reach Your Financial Goals | Stash Learn

Saving and investing are different—and each serves a unique purpose in a financial plan. When you learn the distinction, you can plan with more confidence.......

www.stash.com

3 amazing benefits of investing | Why you should invest Fidelity

The ups and downs of the stock market can seem rough, but the advantages of investing may help you reach your goals. Find out why. ......

www.fidelity.com

Top 3 reasons to save more money today | Discover

Why should you put money into a savings account? Consider these top 3 reasons why you should save money now and start building your financial future today.......

www.discover.com

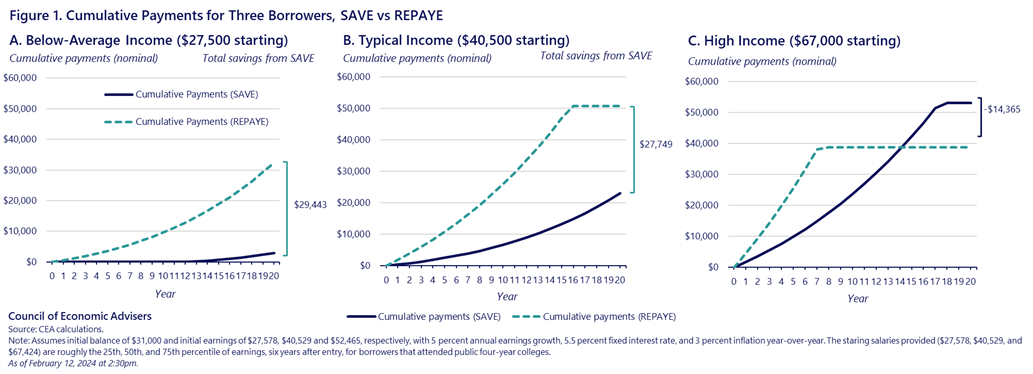

Issue Brief: The Benefits of SAVE | CEA | The White House

......

www.whitehouse.gov

/cdn.vox-cdn.com/uploads/chorus_asset/file/25460210/google_ai_overview_example.png)