- RESOURCES -

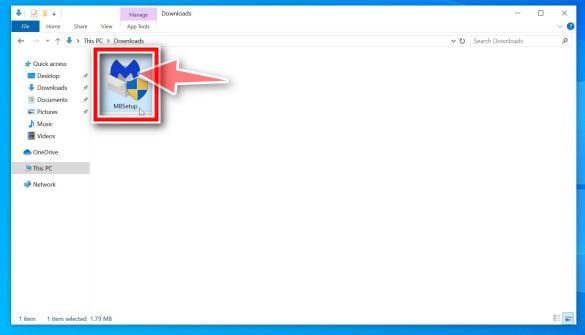

Finage | Blog The Impact of Economic Indicators on Stock Market Indices

......

finage.co.uk

Learning the Significance of Key Economic Indicators | PIMCO

Macroeconomic trends, like changes in gross domestic product (GDP), interest rates, employment, as well as consumer and business spending, affect how financial markets perform. Understanding these indicators and how they influence various asset class......

www.pimco.com

Economic Indicators : U.S. Bureau of Labor Statistics

Economic Indicators......

www.bls.gov

:max_bytes(150000):strip_icc()/GettyImages-1334805075-4835a10799c74a6b945dfbd742a1f4df.jpg)

Macroeconomic Indicators That Affect the US Stock Market

Macroeconomic factors like GDP, inflation, employment, and retail sales affect the value of your portfolio. Understanding these economic indicators is vital for every investor in the marketplace.......

www.investopedia.com

10 Economic Indicators Every Business Owner Should Know | J.P. Morgan

By monitoring economic indicators, midsize business owners can gain insights and make informed decisions to navigate challenges and seize opportunities.......

www.jpmorgan.com

:max_bytes(150000):strip_icc()/GettyImages-1338652193-3c696ddd69894e4ba3c1be31ba64dde7.jpg)