- RESOURCES -

Lesson 3: Patience is a Virtue. Do Less for More Wealth | by Eoghan Mcnulty | The Dark Side

Alongside Lesson 2 about time, patience is another key philosophical pillar any good investor needs. Patience throughout your investing life will be to your benefit.......

medium.com

Patience Usually Results in Success | United Financial Center

......

www.unitedfinancial.net

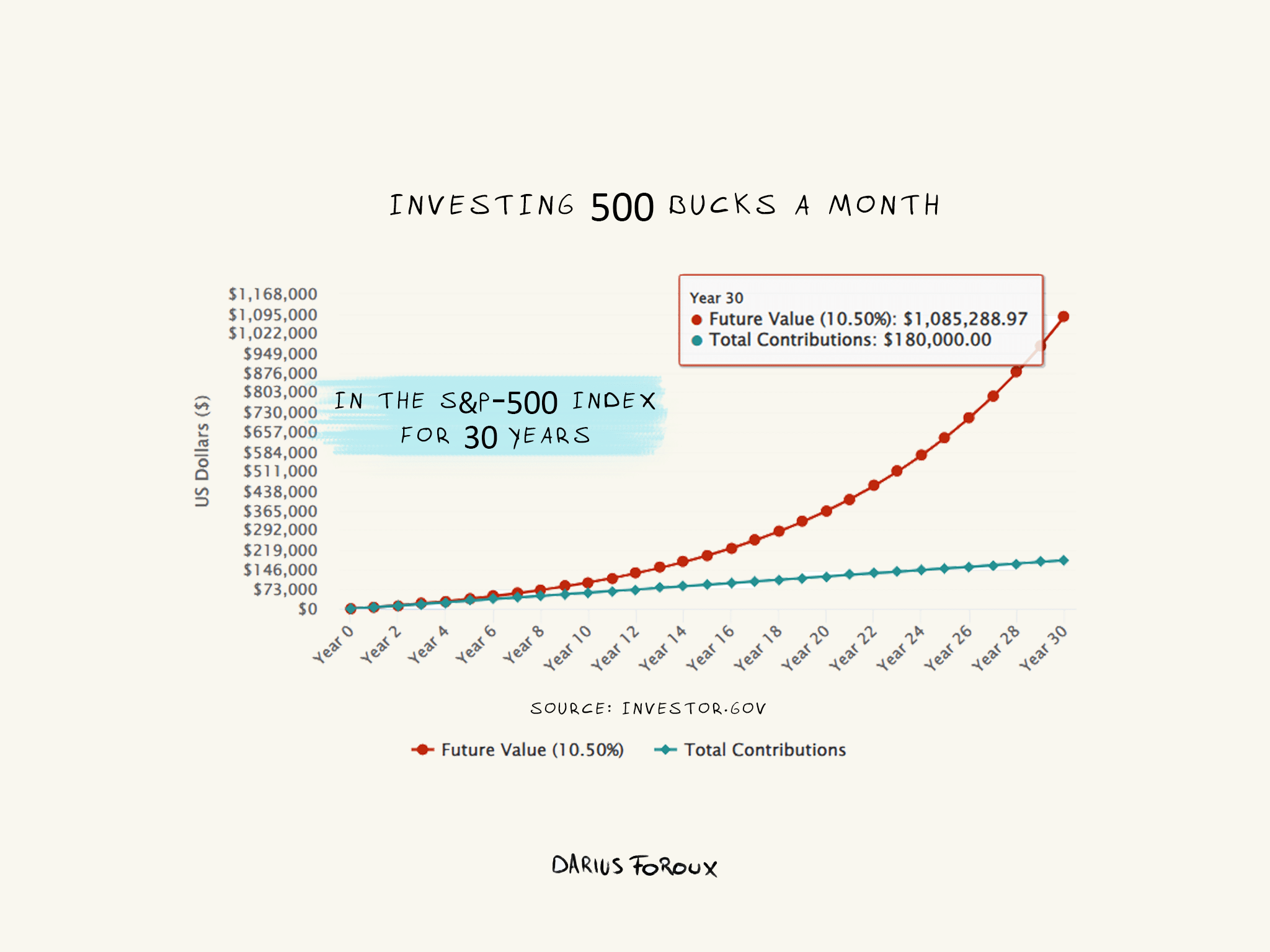

The Art of Patience: How Delayed Gratification Builds Wealth

To build proper wealth, you need delayed gratification. I always say I’m the most impatient person in the world.......

dariusforoux.com

How Patience Pays Off — Permanent Equity: Investing in Companies that Care What Happens Next

Patience is hard – in life and in investing. But it lets you think

differently about risk and reward in private equity, align incentives,

figure out priorities, and reinvest in things known to be valuable –

building capacity, capability, and re......

www.permanentequity.com

How to Beat Investing FOMO: The Power of Patient Wealth Building | Madison Partners

Can you relate to any of the following? “I should have bought that stock before the company went public!” “What a shame — I wish I had invested in that new tech before it went mainstream!” What’s the next “unicorn” that will make a fortune?” It’s com......

www.themadisonpartners.com